Toronto – January 8, 2024 – PPX Mining Corp. (the “Company” or “PPX”)is pleased to announce an updated Mineral Resource Estimate for the Callanquitas gold–silver deposit and a geological potential study on the Company’s wholly-owned IGOR project, located in northwestern Perú, approximately 150 kilometers northeast of the city of Trujillo in the Huaranchal district of the La Libertad Region.

The NI 43-101 technical document shall be available within the regulatory filing timeframe and was carried out by the following independent consultants: a) Mining Plus Peru S.A.C., engineering firm responsible for the Callanquitas deposit resource estimate update and b) Geologica Groupe-Conseil Inc., responsible for the geological review, analysis and data compilation to determine the potential of the Igor Project.

Highlights:

- Measured & Indicated (“M&I”) Resources as oxides: 81,090 Au ounces and 2.9 million Ag ounces.

- M&I Resources as oxides: 100,290 AuEq ounces at 4.70 g/t AuEq.

- Inferred Resources as sulfides: 34,450 AuEq ounces at 4.63 g/t AuEq.

- Potential for additional resources in Callanquitas East as it remains completely open at depth and along strike to the north and south.

- The potential of Callanquitas West, which runs close to and parallel to the eastern zone and mirrors Callanquitas East, must be explored. Minimum exploration has been conducted in this zone.

- The presence of sulfide ore along strike to the south of the present workings has largely been ignored in favor of oxide ore and additional exploration has the potential to define sulfide structures, known from limited production to carry elevated silver grades.

- There is a high potential to increase resources in the areas of Portachuelos, Domo, and Tesoros

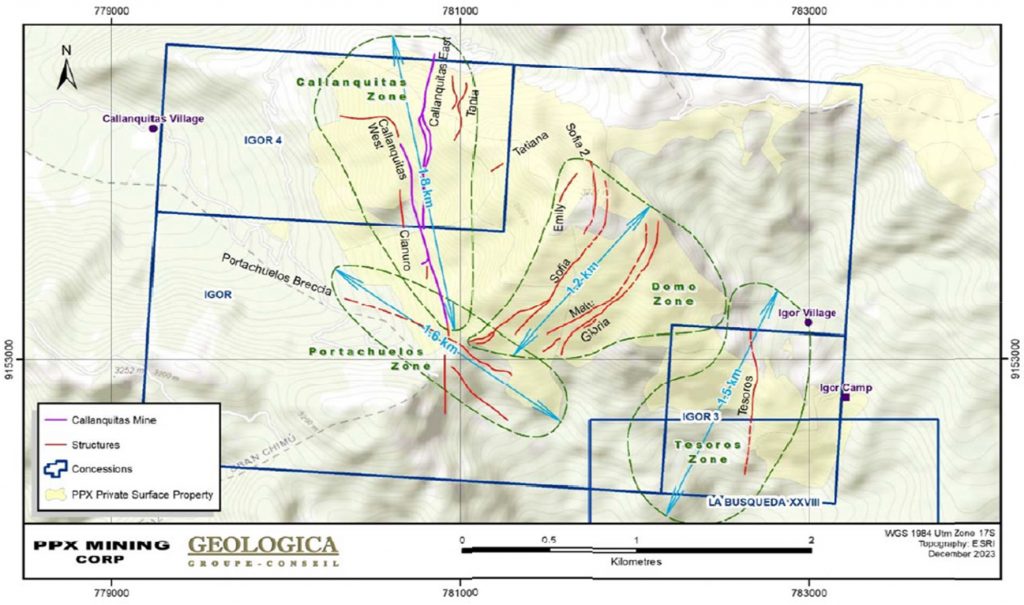

- The extension of Portachuelos, Domo and Tesoros zones is significant, each being 1.2 to 2 km in length with mineralized structures showing widths from 2 to 5 meters.

John Thomas, CEO of PPX Mining commented: “I am pleased to announce that resources from a section of the Callanquitas veins/breccias remain, allowing PPX to continue operations and to expedite the plant construction (for oxide and sulphide ore), while continuing to expand resources with diamond drilling campaigns from the subsurface and surface of the East and West Callanquitas veins/breccias, targeting the open areas along strike and at depth. Currently, the company, in coordination with its mining partner PLP, is conducting a drilling campaign from the subsurface, and we are excited that Canadian geology consultants are demonstrating the potential of the other mineralized zones of the Igor project, such as Portachuelos, Domo and Tesoros, with clear evidence of high gold and silver grades, offering an excellent opportunity to increase the company’s resources.”

- MINERAL RESOURCE UPDATE

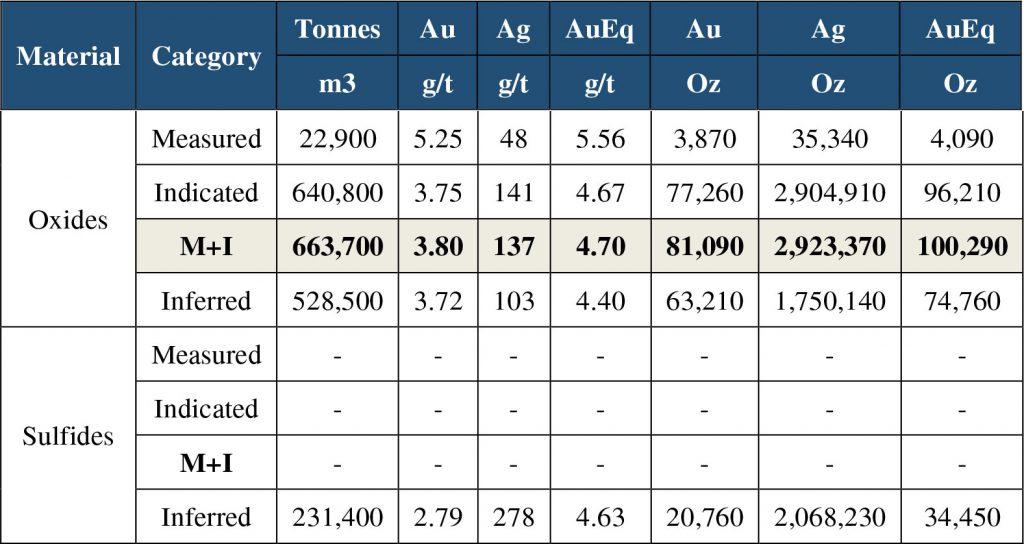

Table 1: Callanquitas Mineral Resource as of 30 September 2023

Notes:

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- The MRE has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

- All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

- The Mineral Resource was estimated by Ms Muñoz QP(Geo) of Mining Plus, Independent Qualified Person under NI 43-101.

- The Mineral Resource is reported inside an underground shell with a cut-off grade of 2.00 g/t gold equivalent, estimated using a gold price of 1,800 US$/oz and silver price of US$ 20 US$/oz.

- MRE is reported on a 100 percent basis within an underground shell. The gold equivalent is based in the following formula AuEq = Au + Ag*0.0066.

- This report is dated the 7 November 2023 and has an effective date of 30 September 2023.

- The cut-off date for mining depletion is 30 September 2023.

Mineral Resource Estimate

The Mineral Resources Estimate for the Callanquitas Deposit was prepared by Ms. María Muñoz, full-time employee of Mining Plus Peru S.A.C. The Mineral Resources within the Callanquitas gold-silver deposit are deemed potentially suitable for underground mining. These estimates are derived from drill holes and channel samples spanning the years 2006 to 2018, as documented in the 2018: “Technical Report and Pre-Feasibility Study for The Callanquitas Gold-Silver Deposit, Igor Project, La Libertad Region, Peru”. Additionally, the data set includes 7 drill holes and 57 channels from 2019, along with 210 channels from 2023; the latest is in the deepest part to evaluate the expansion of resources at depth.

Post-2018, mining activities in the deposit have enhanced the geological understanding, leading to a new geological interpretation. Furthermore, the estimated resources have been adjusted to account for updated economic parameters, ensuring compliance with the “reasonable prospects for eventual economic extraction requirement”. These different aspects have generated a material change in resources, mainly due to mining production which has generated a reduction in resources compared to those reported in 2018.

The Mineral Resource is reported inside underground optimized shapes with a reasonable cut-off grade of 2.00 g/t gold equivalent, based on a gold price of US$1800/oz and silver price of US$20/oz, mining costs and metallurgical recovery from the current mining activities.

The Mineral Resource Estimate (MRE), with an effective date of 30 September 2023, has been reported in accordance with the Canadian National Instrument 43-101 (NI 43-101) Standards for Disclosure for Mineral Projects. The estimation process followed the “Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines” prepared by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM, 2019).

Callanquitas comprises three structures, namely Callanquitas West and Callanquitas East, along with a minor structure named Callanquitas Sigmoid, the latest one is a smaller sigmoid of Callanquitas East. The determination of estimated domains involves a combination of these structures with their associated grade shell. The length sample exhibits variability, although composite lengths of 0.5 m were specifically chosen, representing a multiple of prevalent or dominant raw sampling intervals. Grade capping has been selectively applied to composited grade intervals within each estimation domain. The estimation methodologies for gold and silver grades predominantly employ Ordinary Kriging (OK) across most domains. However, Inverse Distance Square (ID2) was utilized for estimating Callanquitas Sigmoid due to the limited dataset available. To validate the results, bias checks were conducted using nearest neighbor (NN) estimation.

As of September 30, 2023, the MRE includes Measured, Indicated, and Inferred Resources; as Measured and Indicated resources in Oxides, there are around 663,700 tonnes with a gold equivalent grade of 4.70 g/t, with a metal content of 100,290 ounces of gold equivalent, and as Inferred in oxides there are around 528,500 tonnes with a gold equivalent grade of 4.40 g/t, with a metal content of 74,760 ounces of gold equivalent.

Sulfides have been classified as inferred because their information is limited. Mining Plus highlights that the initial Metallurgical tests carried out in-house have demonstrated high recoveries; however, for these resources, the recovery has been considered similar to that of oxides. There are 231,400 tonnes estimated with a gold equivalent grade of 4.63 g/t, with a metal content of 34,450 ounces of gold equivalent.

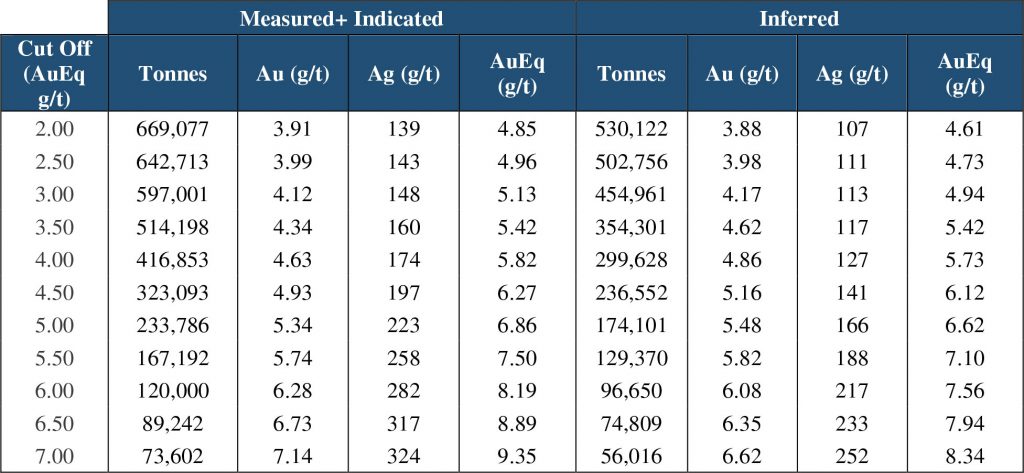

Mineral Resource Estimate Sensitivity

Mining Plus also evaluated the Callanquitas deposit mineral resource estimate for Mineral oxides by cut-off grade range between 2.0 gt/ AuEq and 7.0 g/t AuEq as per the table below:

Table 2: Cut-Off Grade Sensitivity of Mineral Resources for Mineral Oxides

Geological Data

The updated Mineral Resource Estimate includes drill and channel data as of August 2023. It includes an additional data set of 7 drill holes and 57 channels from 2019, along with 210 channels from 2023 made after the previous Mineral Resource dated December 3, 2018. All data information and underground mapping were used to generate a new geological interpretation and domains, resulting in a better understanding and confidence in the resource estimate. The updated mineral resource estimate includes only the Callanquitas deposit.

Geology of Callanquitas

The gold/silver mineralization of Mina Callanquitas corresponds to an intermediate sulfidation system hosted in the magmatic-hydrothermal breccia units that break the Goyllarisquizga sediments. Mineralization in sediments occurs as the filling of secondary fractures due to the low permeability of the rocks. There is an intrusive that also cuts through the sediments where mineralization is medium to low grade.

Callanquitas East structure has a strike of 5° to 10° NE and Callanquitas West has a strike of 340° NE, in both cases the dip is around 87°E with variable thickness, ranging from 0.30 cm to 6.0 m. Sigmoid structure is part of the Callanquitas East structures and is located at the top with sigmoidal behavior.

There is still mineralization potential in the Portachuelos, Tesoros and Domo sectors that have been identified with early exploration, and that have not yet been investigated.

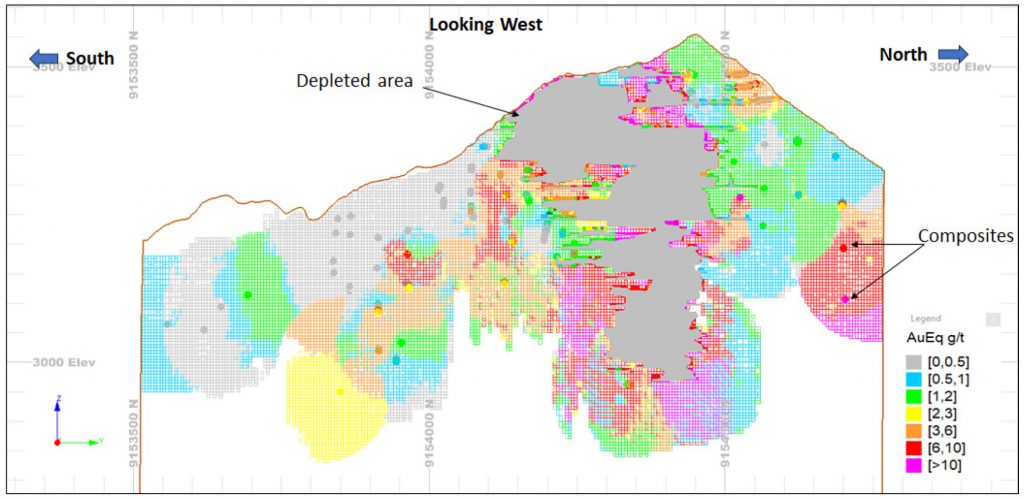

Figure 1: Longitudinal Section with composites and block model coloured by gold equivalent grade – Callanquitas East

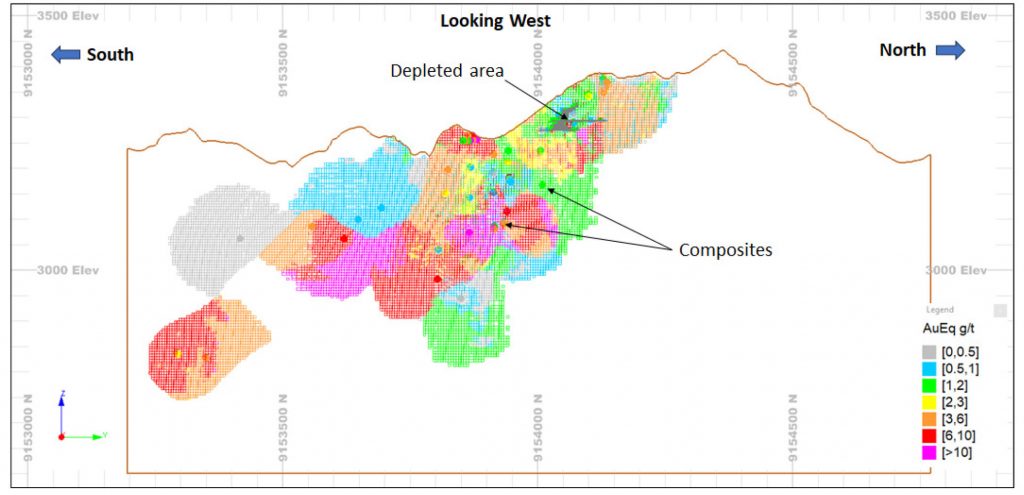

Figure 2: Longitudinal Section with composites and block model coloured by gold equivalent grade – Callanquitas West

QA/QC and Sampling Protocols

PPX adheres to industry-standard exploration methodologies and techniques throughout its exploration process. The collection of drill core and underground samples is conducted under the supervision of the company’s geologists, following established industry practices; data not aligned with the minimum standards set by PPX and industry practices has been excluded from the resource estimation process. Once transported from the drill platform to the logging facility, the drill data is meticulously compared and verified against the core in the trays. Subsequently, the core is logged, photographed, and split using a diamond saw before undergoing sampling. The sampling process involves bagging the samples, with the inclusion of quality control materials at regular intervals. These control materials consist of coarse blanks, certified reference materials, and duplicate core samples, serving to evaluate sampling precision and reproducibility. To maintain a secure chain of custody during sample transportation from the project site to the laboratory, groups of samples are placed in large bags that are sealed with numbered tags.

The majority of sample analyzes were conducted by SGS Laboratories, with ALS Chemex Laboratories contributing to a lesser extent, both laboratories located in Peru. The analytical method was consistent over time, including a multi-element technique with aqua regia digestion followed by ICP/AES detection, including silver values. Gold content was analyzed using a 30 g Fire Assay with an AAS finish. For silver results exceeding 100 g/t, a reanalysis was performed using aqua regia digestion with an ore grade AAS finish, while values exceeding 1,500 g/t underwent analysis using fire assay with a gravimetric finish. Regarding gold, values above 10 g/t underwent re-assay through Fire Assay with gravimetric finishing.

- GEOLOGICAL POTENTIAL OF IGOR PROJECT

Portachuelos, Domo and Tesoros Mineralized Zones

Geologica Groupe-Conseil Inc. (Geologica) has recently conducted evaluations of the geological potential in the three main mineralized zones (Portachuelos, Domo, and Tesoros). Geologica acknowledges that the exploration efforts undertaken by PPX have been adequately executed, employing exploration techniques and methodologies that align with standard practices in the mining industry. The location of these three zones is shown in figure 3. below.

Figure 3: Location of Mineralized zones

Past and recent work completed at the Portachuelos, Domo and Tesoros mineralized zones has indicated lateral extension potential at significant width and grades to justify infill and definition drilling on them. Just like at Callanquitas, interesting grades of gold and silver mineralization have been found in these three (3) main zones. Geologica has independently validated these results through an independent check sampling, encompassing 82 samples (33 channel samples on the surface and 49 drill hole samples), thereby confirming the outcomes obtained in prior work conducted by PPX

The Portachuelos breccia is oriented ESE-WNW. The Domo structures and the Tesoros mineralized zone strike NNE and observed onsite over 1.6 km. The Portachuelos structure and mineralized zone trends SE along lithological contacts and structures trending over 1.5 km and dipping steeply to the SW. Gold and silver mineralization, with locally visible silver, are found in breccias, epithermal veins and mantos that originally contained variable quantities of pyrite, 1% to 25% and massive, arsenopyrite, minor chalcopyrite (< 6% locally), galena (< 4% locally) and sphalerite (< 3% locally). These sulfides have been strongly oxidized to goethite and limonite to depths of 200 to 300 meters below surface. Ag/Au ratios are generally low (about 10:1) in the oxide portion but can increase to over 100:1 at the oxide-sulfide interface at the Callanquitas deposit and similarly at the Portachuelos, Domo and Tesoros mineralized structures.

These mineralized structures show good width from 2 m to 5 m and lateral length extensions from 1.2 km to 2.0 km and are hosted within brecciated and fractured quartzites of the favourable Chimu-Santa Formations and transition zones. The mineralization was injected within altered fractures, faults, fold flanks (mantos) and fold noses. The hot fluids were carrying metal ions from deeper within the intrusion or intrusive magma and formed epithermal veins once cooled. Just like at Callanquitas mine, depth extensions of the three zones (Portachuelos, Domo & Tesoros) could reach 500 meters or more and be open along strike.

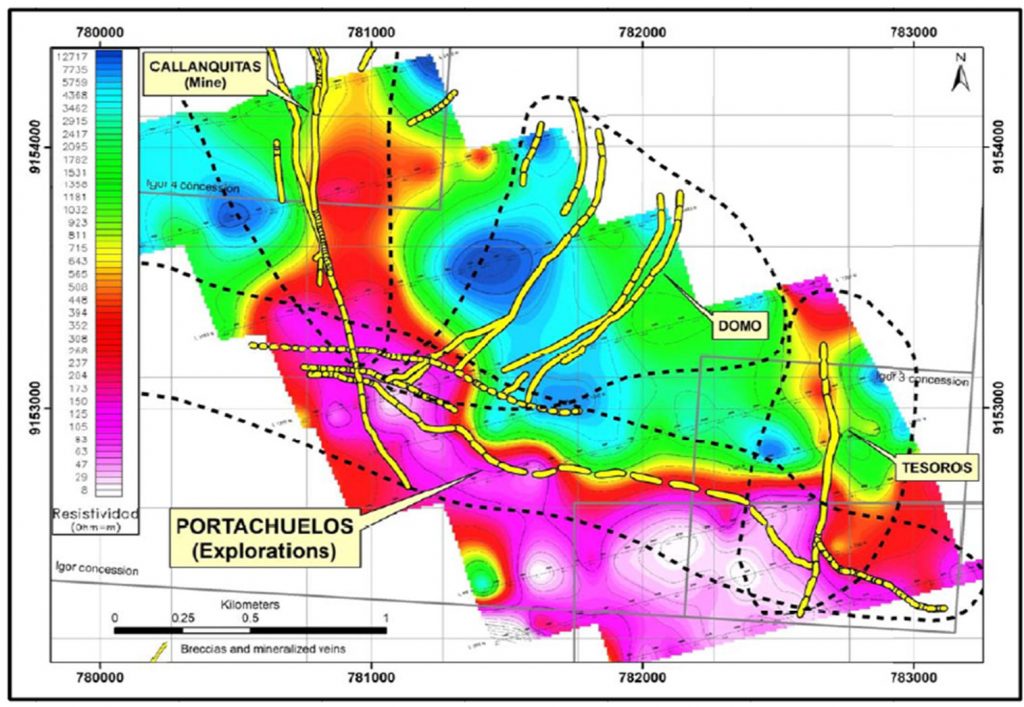

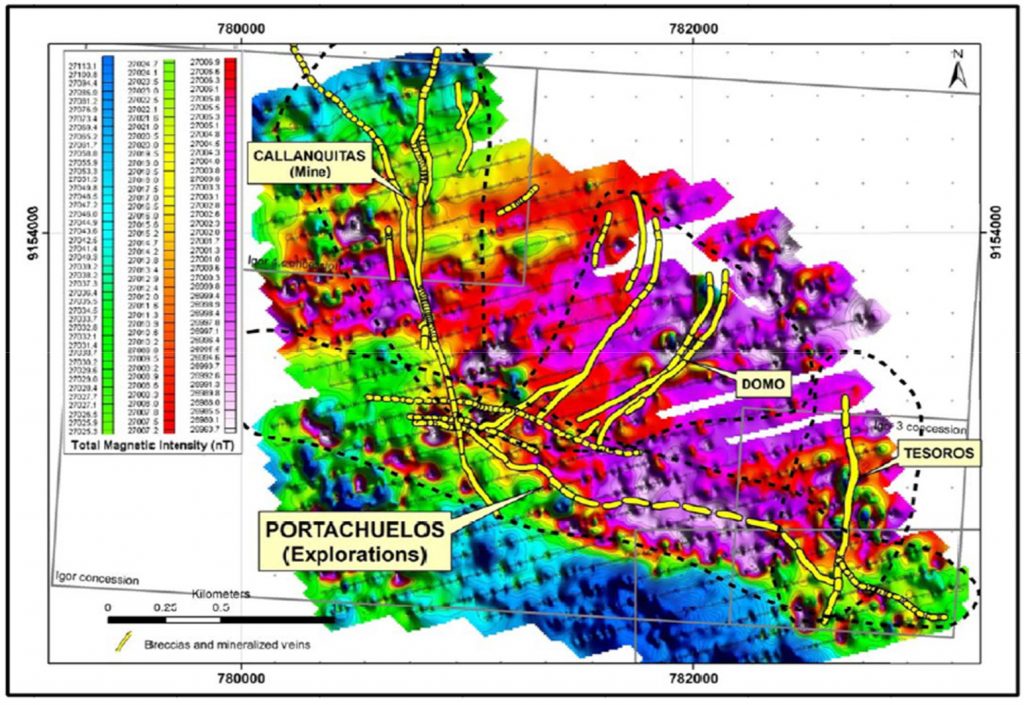

The various geophysical surveys (Mag and IP-Resistivity-Chargeability) permitted location of the mineralized structures and their lateral and depth extensions in the central part of the property covering Callanquitas and Portachuelos. Once drilled, these mineralized structures and extensions will eventually permit ore resource calculation, if warranted. The recent core and channel sampling completed by Geologica has permitted to validate and corroborate the assay results previously obtained by PPX and confirm the presence of significant results as well as to observe the lateral continuity of the mineralized zones. The results of the IP-Resistivity survey and total magnetic survey carried out in 2008 are shown in fig 2 and 3 below.

Figure 4: IP-Resistivity Survey

Figure 5: Total Magnetic Survey

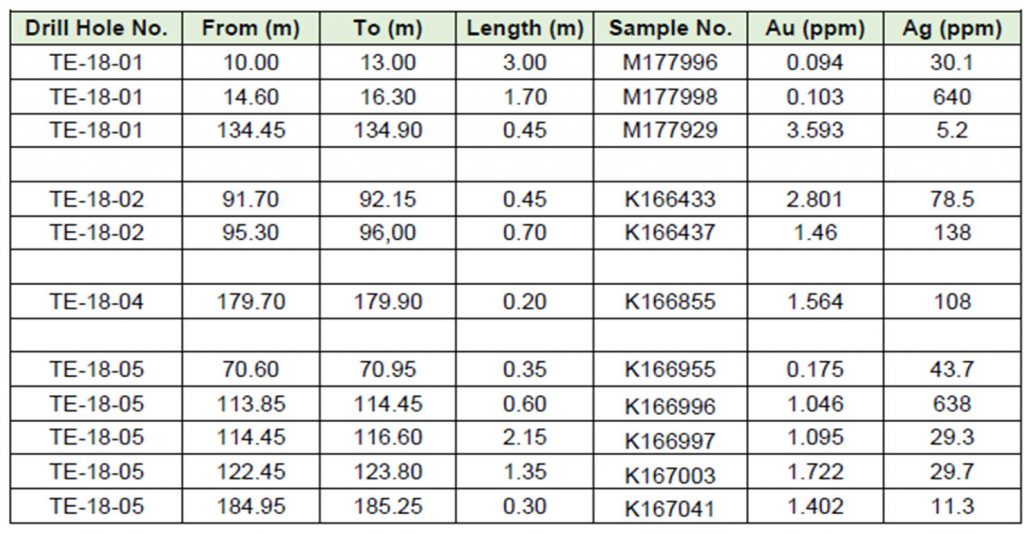

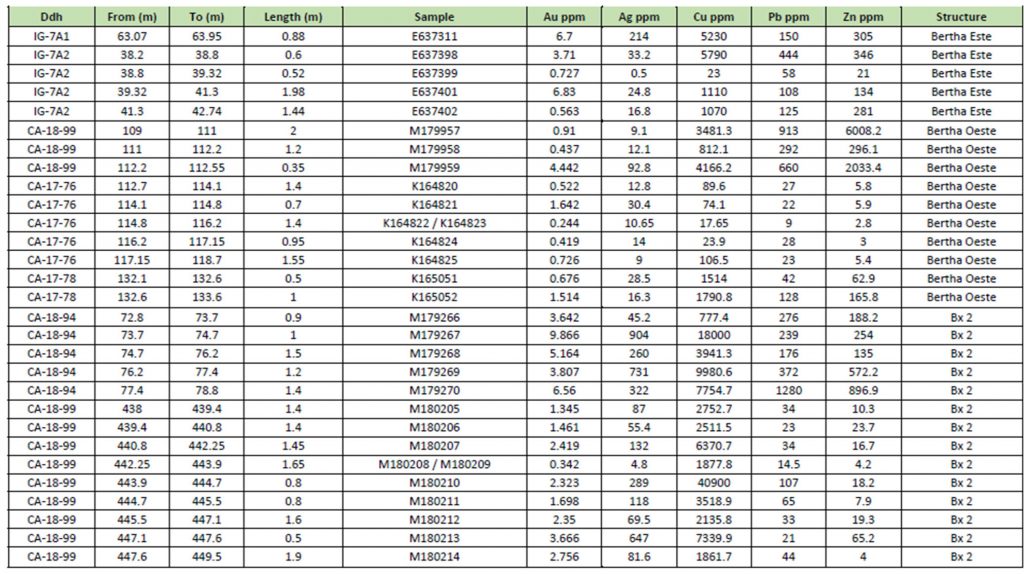

Drill core sampling of the 3 areas has confirmed the mineralization present with grades above 1 g/t ranging from 1.06 g/t to 19.11 g/t Au and silver grades up to 560.94 g/t Ag over widths of 1.04 m to 9.05 m. The channel sampling at the surface has also confirmed the mineralization presence in the three areas with grades above 1 g/t Au ranging from 1.14 g/t to 4.50 g/t Au and silver grades up to 209.00 g/t Ag over channel widths of 0.5 m to 3.8 m. The drill holes have illustrated higher gold grades at depth and were observed in the sampled drill holes and surface channel sampling. The most significant diamond drill hole intersections for the Tesoros zone are shown in Table 3, those for Portachuelos in Table 4.

Table 3: Most significant diamond drill hole intersections for the Tesoros zone

Table 2: Most significant diamond drill hole intersections for the Portachuelos zone

Geologica is of the opinion that the Property is one of merit with mineralized structures (Callanquitas, Portachuelos, Tesoros and Domo) and this warrants further exploration with the following Phases. Phase 1 surface exploration work program will consist of surface detailed geological mapping, soil geochemical surveys, geophysical surveys with Gravity, Magnetometric (Mag) and Induced Polarization (IP-Resistivity), at a higher resolution than the previous work, anomalous Geochem and Geophysical anomalies will be followed by mechanical trenching, detailed geological mapping and sampling, particularly over the three zone extensions (Portachuelos, Domo and Tesoros) and a first phase of drilling (1 DDH by zone). Phase 2 will consist in diamond drilling with both infill and definition drilling on all three (3) zones. A total budget of $4,223,000 is recommended.

Marcial Gutierrez, General Manager and Chief Geologist, commented, “We will continue to advance our exploration plans to expand the Callanquitas resource, in both, Callanquitas East, which is widely open at depth and along strike, and Callanquitas West, which is expected to mirror the high grade zones of the eastern breccia. Other key mineralized zones have been partially explored in the past and appear to be extensive and prospective. The Geologica Consultants recommendation for carrying out higher resolution geophysics and further drilling will certainly contribute to advance these key zones towards a resource definition, although widespread gold mineralization has already been found through the limited drilling in Portachuelos, making this massive structure a priority drilling target.”

Qualified Persons and Technical Information

The Mineral Resources Estimate was estimated by Ms. Maria Muñoz, a member of the Australian Institute of Geoscientists (MAIG), Ms. Muñoz is a full-time employee of Mining Plus Peru S.A.C. and she is an independent Qualified Person (QP) as defined by the National Instrument 43-101.

Mr. Alain-Jean Beauregard, Mr. Eddy Canova, and Mr. Daniel Gaudreault, all full-time employees of Geologica Groupe-Conseil Inc. and recognized as independent Qualified Persons (QP’s) under the National Instrument 43-101, conducted an assessment of the geological potential of the Portachuelos, Domo, and Tesoros mineralized zones. During their visit to the Igor Property from November 3 to 7, 2023, Mr. Beauregard and Mr. Canova thoroughly examined and sampled the core, underground workings, and adits, with a specific focus on the three primary mineralized zones. Geologica is an independent mining exploration consulting firm based in Val-d’Or (Quebec), Canada.

The Qualified Persons (QP’s) have reviewed and approved the technical content of this release.

The full technical report, which is being prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101) by Mining Plus, will be available on SEDAR (www.sedar.com) under the Company’s issuer profile within 45 days from this news release. The effective date of the current mineral resource estimate is September 30, 2023. The 2018 Pre-Feasibility Study is no longer current and as such should not be relied upon.

About PPX Mining Corp:

PPX Mining Corp. (TSX.V: PPX.V, BVL: PPX) is a Canadian-based mining company with assets in northern Peru. Igor, the Company’s 100%-owned flagship gold and silver project, is located in the prolific Northern Peru gold belt in eastern La Libertad Department.

On behalf of the Board of Directors

John Thomas

Chief Executive Officer

82 Richmond Street East

Toronto, Ontario M5C 1P1

Canada

416-361-0737

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement:

This press release contains forward-looking information and forward-looking statements (collectively, “forward-looking statements”) as such terms are defined by applicable securities laws, including, but not limited to statements regarding future financing and plans and / or management estimates. Forward-looking statements are statements that relate to future events. In this context, forward-looking statements often address expected future business plans and financial performance and often contain words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” and “intend,”, statements that an action or event “may,” “might,” “could,” “should,” or “will” be taken or occur, or other similar expressions. Forward-looking statements are subject to a number of known and unknown risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s control, and the Company’s actual results could differ materially from those stated or implied in forward-looking statements due to many various factors. Such uncertainties and risks include, among others, delays in obtaining or inability to obtain any required regulatory approvals, if applicable. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee that the events and circumstances reflected in the forward-looking statements will be achieved or occur. The timing of events and circumstances and actual results could differ materially from those projected in the forward-looking statements. Accordingly, one should not place undue reliance on forward- looking statements. All forward-looking statements contained in this press release are made as of today’s date, and the Company undertakes no obligation to update or publicly revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law.